Page 135 - ICD-AR22-English

P. 135

Notes to the Separate Financial Statements

FOR THE YEAR ENDED 31 DECEMBER 2022

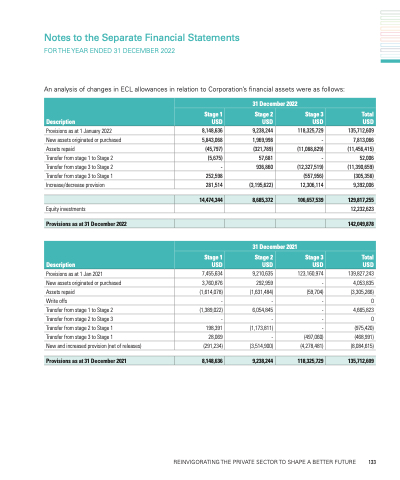

An analysis of changes in ECL allowances in relation to Corporation’s financial assets were as follows:

Description

31 December 2022

Stage 1 USD

Stage 2 USD

Stage 3 USD

Total USD

Provisions as at 1 January 2022 8,148,636

New assets originated or purchased 5,843,068 Assets repaid (45,797) Transfer from stage 1 to Stage 2 (5,675) Transfer from stage 3 to Stage 2 - Transfer from stage 3 to Stage 1 252,598 Increase/decrease provision 281,514

9,238,244

1,969,998 (321,789) 57,681 936,860

(3,195,622)

118,325,729

-

(11,088,829)

-

(12,327,519)

(557,956)

12,306,114

135,712,609

7,813,066

(11,456,415)

52,006

(11,390,659)

(305,358)

9,392,006

14,474,344

8,685,372

106,657,539

129,817,255

Equity investments

12,232,623

Provisions as at 31 December 2022

142,049,878

Description

31 December 2021

Stage 1 USD

Stage 2 USD

Stage 3 USD

Total USD

Provisions as at 1 Jan 2021 7,455,634

New assets originated or purchased 3,760,876 Assets repaid (1,614,078) Writeoffs - Transfer from stage 1 to Stage 2 (1,389,022) Transfer from stage 2 to Stage 3 - Transfer from stage 2 to Stage 1 198,391 Transfer from stage 3 to Stage 1 28,069 New and increased provision (net of releases) (291,234)

9,210,635

292,959 (1,631,484) - 6,054,845 - (1,173,811) - (3,514,900)

123,160,974

-

(59,704)

-

-

-

-

(497,060)

(4,278,481)

139,827,243

4,053,835

(3,305,266)

0

4,665,823

0

(975,420)

(468,991)

(8,084,615)

Provisions as at 31 December 2021

8,148,636

9,238,244

118,325,729

135,712,609

REINVIGORATING THE PRIVATE SECTOR TO SHAPE A BETTER FUTURE 133