Page 116 - ICD-AR22-English

P. 116

Notes to the Separate Financial Statements

FOR THE YEAR ENDED 31 DECEMBER 2022

SPP

The expected employer contribution for year ended 31 December 2022 is USD 3.5 million and expected costs to be recognized in profit or loss is USD 6.3 million.

SRMP

The expected employer contribution for year ended 31 December 2022 is USD 18.6 k and expected costs to be recognized in profit or loss is USD 47.3k.

RMSP

The expected employer contribution for year ended 31 December 2022 is USD 473.1k and expected costs to be recognized in profit or loss is USD (1.7 million).

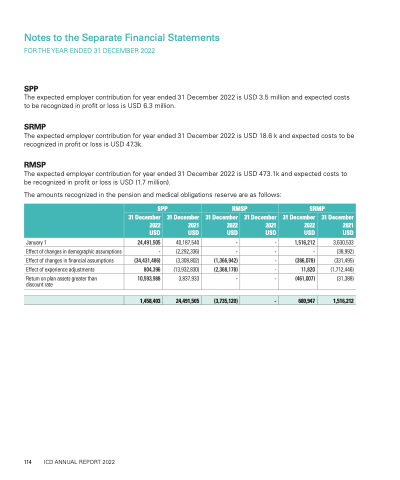

The amounts recognized in the pension and medical obligations reserve are as follows:

SPP

RMSP

SRMP

31 December 2022 USD

31 December 2021 USD

31 December 2022 USD

31 December 2021 USD

31 December 2022 USD

31 December 2021 USD

January 1

Effect of changes in demographic assumptions

Effect of changes in financial assumptions Effect of experience adjustments

24,491,505

-

(34,431,486) 804,396

40,187,540

(2,292,336)

(3,308,802) (13,932,830)

- -

- -

(1,366,942) -

(2,368,178) -

1,516,212

-

(386,078)

11,820

3,630,533

(38,992)

(331,495)

(1,712,446)

Return on plan assets greater than discount rate

10,593,988

3,837,933

-

-

(461,007)

(31,388)

1,458,403

24,491,505

(3,735,120)

-

680,947

1,516,212

114 ICD ANNUAL REPORT 2022