Page 109 - ICD-AR22-English

P. 109

Notes to the Separate Financial Statements

FOR THE YEAR ENDED 31 DECEMBER 2022

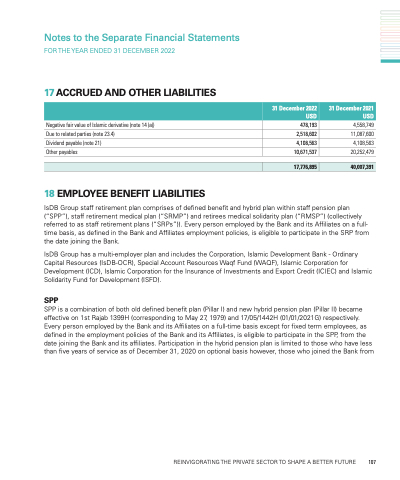

17 ACCRUED AND OTHER LIABILITIES Negative fair value of Islamic derivative (note 14 (a))

Due to related parties (note 23.4) Dividend payable (note 21) Other payables

18 EMPLOYEE BENEFIT LIABILITIES

478,193 2,518,602 4,108,563

10,671,537

4,558,749 11,087,600 4,108,563

20,252,479

31 December 2022 USD

31 December 2021 USD

17,776,895

40,007,391

IsDB Group staff retirement plan comprises of defined benefit and hybrid plan within staff pension plan (“SPP”), staff retirement medical plan (“SRMP”) and retirees medical solidarity plan (“RMSP”) (collectively referred to as staff retirement plans (“SRPs”)). Every person employed by the Bank and its Affiliates on a full- time basis, as defined in the Bank and Affiliates employment policies, is eligible to participate in the SRP from the date joining the Bank.

IsDB Group has a multi-employer plan and includes the Corporation, Islamic Development Bank - Ordinary Capital Resources (IsDB-OCR), Special Account Resources Waqf Fund (WAQF), Islamic Corporation for Development (ICD), Islamic Corporation for the Insurance of Investments and Export Credit (ICIEC) and Islamic Solidarity Fund for Development (ISFD).

SPP

SPP is a combination of both old defined benefit plan (Pillar I) and new hybrid pension plan (Pillar II) became effective on 1st Rajab 1399H (corresponding to May 27, 1979) and 17/05/1442H (01/01/2021G) respectively. Every person employed by the Bank and its Affiliates on a full-time basis except for fixed term employees, as defined in the employment policies of the Bank and its Affiliates, is eligible to participate in the SPP, from the date joining the Bank and its affiliates. Participation in the hybrid pension plan is limited to those who have less than five years of service as of December 31, 2020 on optional basis however, those who joined the Bank from

REINVIGORATING THE PRIVATE SECTOR TO SHAPE A BETTER FUTURE 107