Page 107 - ICD-AR22-English

P. 107

Notes to the Separate Financial Statements

FOR THE YEAR ENDED 31 DECEMBER 2022

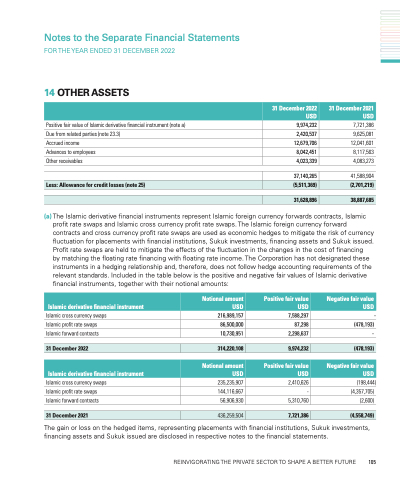

14 OTHER ASSETS

Positive fair value of Islamic derivative financial instrument (note a)

Due from related parties (note 23.3) Accrued income

Advances to employees

Other receivables

9,974,232

2,420,537 12,679,706

8,042,451

4,023,339

7,721,386

9,625,081 12,041,601

8,117,563

4,083,273

31 December 2022 USD

31 December 2021 USD

37,140,265

41,588,904

Less: Allowance for credit losses (note 25)

(5,511,369)

(2,701,219)

31,628,896

38,887,685

(a) The Islamic derivative financial instruments represent Islamic foreign currency forwards contracts, Islamic profit rate swaps and Islamic cross currency profit rate swaps. The Islamic foreign currency forward contracts and cross currency profit rate swaps are used as economic hedges to mitigate the risk of currency fluctuation for placements with financial institutions, Sukuk investments, financing assets and Sukuk issued. Profit rate swaps are held to mitigate the effects of the fluctuation in the changes in the cost of financing

by matching the floating rate financing with floating rate income. The Corporation has not designated these instruments in a hedging relationship and, therefore, does not follow hedge accounting requirements of the relevant standards. Included in the table below is the positive and negative fair values of Islamic derivative financial instruments, together with their notional amounts:

Islamic derivative financial instrument

Notional amount USD

Positive fair value USD

Negative fair value USD

Islamic cross currency swaps Islamic profit rate swaps Islamic forward contracts

Islamic cross currency swaps Islamic profit rate swaps Islamic forward contracts

216,989,157

86,500,000

10,730,951

235,235,907

144,116,667

56,906,930

7,588,297

87,298

2,298,637

2,410,626

-

5,310,760

-

(478,193)

-

(198,444)

(4,357,705)

(2,600)

31 December 2022

314,220,108

9,974,232

(478,193)

Islamic derivative financial instrument

Notional amount USD

Positive fair value USD

Negative fair value USD

31 December 2021

436,259,504

7,721,386

(4,558,749)

The gain or loss on the hedged items, representing placements with financial institutions, Sukuk investments, financing assets and Sukuk issued are disclosed in respective notes to the financial statements.

REINVIGORATING THE PRIVATE SECTOR TO SHAPE A BETTER FUTURE 105