Page 99 - ICD-AR22-English

P. 99

Notes to the Separate Financial Statements

FOR THE YEAR ENDED 31 DECEMBER 2022

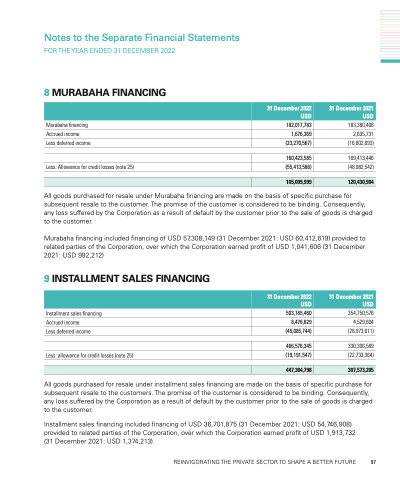

8 MURABAHA FINANCING Murabaha financing

Accrued income

Less deferred income

Less: Allowance for credit losses (note 25)

182,017,783

1,676,369

(23,270,567)

160,423,585 (55,413,586)

183,380,408

2,635,731

(16,602,693)

169,413,446 (48,982,542)

31 December 2022 USD

31 December 2021 USD

105,009,999

120,430,904

All goods purchased for resale under Murabaha financing are made on the basis of specific purchase for subsequent resale to the customer. The promise of the customer is considered to be binding. Consequently, any loss suffered by the Corporation as a result of default by the customer prior to the sale of goods is charged to the customer.

Murabaha financing included financing of USD 57,308,149 (31 December 2021: USD 60,412,619) provided to related parties of the Corporation, over which the Corporation earned profit of USD 1,041,606 (31 December 2021: USD 992,212)

9 INSTALLMENT SALES FINANCING Installment sales financing

Accrued income

Less deferred income

Less: allowance for credit losses (note 25)

503,185,460

8,476,629

(45,085,744)

466,576,345 (19,191,547)

354,750,576

4,529,604

(28,973,611)

330,306,569 (22,733,364)

31 December 2022 USD

31 December 2021 USD

447,384,798

307,573,205

All goods purchased for resale under installment sales financing are made on the basis of specific purchase for subsequent resale to the customers. The promise of the customer is considered to be binding. Consequently, any loss suffered by the Corporation as a result of default by the customer prior to the sale of goods is charged to the customer.

Installment sales financing included financing of USD 36,701,875 (31 December 2021: USD 54,746,908) provided to related parties of the Corporation, over which the Corporation earned profit of USD 1,913,732 (31 December 2021: USD 1,374,213).

REINVIGORATING THE PRIVATE SECTOR TO SHAPE A BETTER FUTURE 97