Page 16 - ICD-AR22-English

P. 16

2.2 2022 in Review

Given its importance in job creation,

unleashing export potential and in driving sustainable growth, private sector development has been the primary focus of ICD since inception.

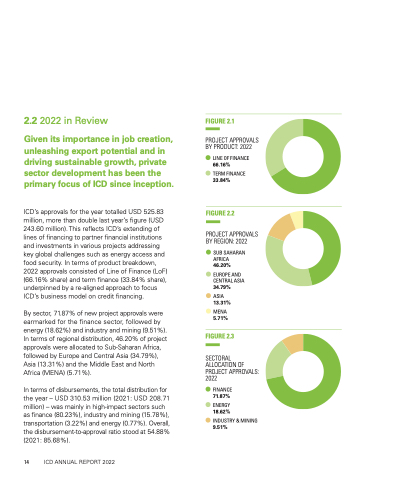

ICD’s approvals for the year totalled USD 525.83 million, more than double last year’s figure (USD 243.60 million). This reflects ICD’s extending of lines of financing to partner financial institutions and investments in various projects addressing key global challenges such as energy access and food security. In terms of product breakdown, 2022 approvals consisted of Line of Finance (LoF) (66.16% share) and term finance (33.84% share), underpinned by a re-aligned approach to focus ICD’s business model on credit financing.

By sector, 71.87% of new project approvals were earmarked for the finance sector, followed by energy (18.62%) and industry and mining (9.51%). In terms of regional distribution, 46.20% of project approvals were allocated to Sub-Saharan Africa, followed by Europe and Central Asia (34.79%), Asia (13.31%) and the Middle East and North Africa (MENA) (5.71%).

In terms of disbursements, the total distribution for the year – USD 310.53 million (2021: USD 208.71 million) – was mainly in high-impact sectors such as finance (80.23%), industry and mining (15.78%), transportation (3.22%) and energy (0.77%). Overall, the disbursement-to-approval ratio stood at 54.88% (2021: 85.68%).

FIGURE 2.1

PROJECT APPROVALS BY PRODUCT: 2022

● LINE OF FINANCE 66.16%

● TERM FINANCE 33.84%

FIGURE 2.2

PROJECT APPROVALS BY REGION: 2022

● SUB SAHARAN AFRICA

46.20%

● EUROPE AND CENTRAL ASIA 34.79%

● ASIA 13.31%

● MENA 5.71%

FIGURE 2.3

SECTORAL ALLOCATION OF PROJECT APPROVALS: 2022

● FINANCE 71.87%

● ENERGY 18.62%

● INDUSTRY & MINING 9.51%

14 ICD ANNUAL REPORT 2022