Page 143 - ICD-AR22-English

P. 143

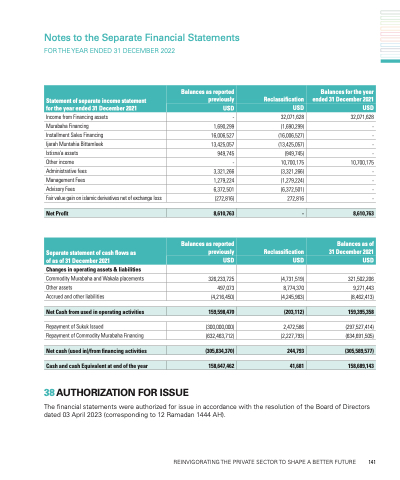

Notes to the Separate Financial Statements

FOR THE YEAR ENDED 31 DECEMBER 2022

Income from Financing assets

Murabaha Financing

Installment Sales Financing

Ijarah Muntahia Bittamleek

Istisna'a assets

Other income

Administrative fees

Management Fees

Advisory Fees

Fair value gain on islamic derivatives net of exchange loss

Changes in operating assets & liabilities

Commodity Murabaha and Wakala placements Other assets

Accrued and other liabilities

Repayment of Sukuk Issued

Repayment of Commodity Murabaha Financing

-

1,690,299 16,006,527 13,425,057

949,745 - 3,321,266 1,279,224 6,372,501 (272,816)

32,071,628 32,071,628

(1,690,299) - (16,006,527) - (13,425,057) -

(949,745) - 10,700,175 10,700,175 (3,321,266) - (1,279,224) - (6,372,501) -

272,816 -

Statement of separate income statement for the year ended 31 December 2021

Balances as reported previously

Reclassification

Balances for the year ended 31 December 2021

USD

USD

USD

Net Profit

8,610,763

-

8,610,763

Separate statement of cash flows as of as of 31 December 2021

Balances as reported previously

Reclassification

Balances as of 31 December 2021

USD

USD

USD

326,233,725 497,073 (4,216,450)

(300,000,000) (632,463,712)

(4,731,519) 321,502,206 8,774,370 9,271,443 (4,245,963) (8,462,413)

2,472,586 (297,527,414) (2,227,793) (634,691,505)

Net Cash from used in operating activities

159,598,470

(203,112)

159,395,358

Net cash (used in)/from financing activities

(305,834,370)

244,793

(305,589,577)

Cash and cash Equivalent at end of the year

158,647,462

41,681

158,689,143

38 AUTHORIZATION FOR ISSUE

The financial statements were authorized for issue in accordance with the resolution of the Board of Directors

dated 03 April 2023 (corresponding to 12 Ramadan 1444 AH).

REINVIGORATING THE PRIVATE SECTOR TO SHAPE A BETTER FUTURE 141