Page 129 - ICD-AR22-English

P. 129

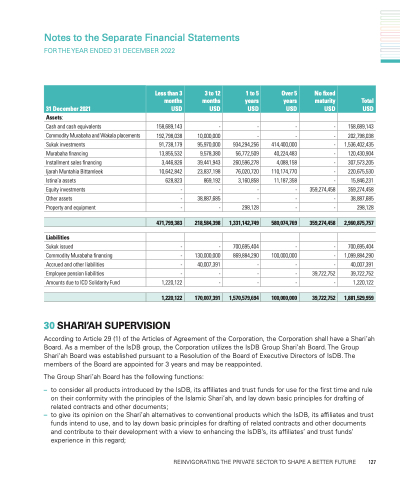

Notes to the Separate Financial Statements

FOR THE YEAR ENDED 31 DECEMBER 2022

31 December 2021

Less than 3 months USD

3to12 months USD

1to5 years USD

Over 5 years USD

No fixed maturity USD

Total USD

Assets:

Cash and cash equivalents

Commodity Murabaha and Wakala placements Sukuk investments

Murabaha financing

Installment sales financing

Ijarah Muntahia Bittamleek Istina’a assets

Equity investments

Other assets

Property and equipment

Liabilities

Sukuk issued

Commodity Murabaha financing Accrued and other liabilities Employee pension liabilities Amounts due to ICD Solidarity Fund

158,689,143

192,798,038 91,738,179 13,855,532

3,446,826 10,642,842 628,823 - - -

- - - -

1,220,122

-

10,000,000 95,970,000 9,578,380 39,441,943 23,837,198 869,192 - 38,887,685 -

- 130,000,000 40,007,391 - -

-

-

934,294,256

56,772,509

260,596,278

76,020,720

3,160,858

-

-

298,128

700,695,404

869,884,290

-

-

-

- -

- -

414,400,000 -

40,224,483 -

4,088,158 -

110,174,770 -

11,187,358 -

- 359,274,458

- -

- -

- -

100,000,000 -

- -

- 39,722,752

- -

158,689,143

202,798,038

1,536,402,435

120,430,904

307,573,205

220,675,530

15,846,231

359,274,458

38,887,685

298,128

700,695,404

1,099,884,290

40,007,391

39,722,752

1,220,122

471,799,383

218,584,398

1,331,142,749

580,074,769

359,274,458

2,960,875,757

1,220,122

170,007,391

1,570,579,694

100,000,000

39,722,752

1,881,529,959

30 SHARI’AH SUPERVISION

According to Article 29 (1) of the Articles of Agreement of the Corporation, the Corporation shall have a Shari’ah Board. As a member of the IsDB group, the Corporation utilizes the IsDB Group Shari’ah Board. The Group Shari'ah Board was established pursuant to a Resolution of the Board of Executive Directors of IsDB. The members of the Board are appointed for 3 years and may be reappointed.

The Group Shari’ah Board has the following functions:

– to consider all products introduced by the IsDB, its affiliates and trust funds for use for the first time and rule on their conformity with the principles of the Islamic Shari’ah, and lay down basic principles for drafting of related contracts and other documents;

– to give its opinion on the Shari’ah alternatives to conventional products which the IsDB, its affiliates and trust funds intend to use, and to lay down basic principles for drafting of related contracts and other documents and contribute to their development with a view to enhancing the IsDB’s, its affiliates’ and trust funds’ experience in this regard;

REINVIGORATING THE PRIVATE SECTOR TO SHAPE A BETTER FUTURE 127